We have found that more and more organizations are ready to ditch their annual budgets and convert to a monthly Rolling Forecast Model. Why? First, they have realized that the assumptions in their budgets easily are obsolete due to circumstances out of their control. It soon makes less sense to track and compare actual against an obsolete budget. Second, the time frame to year-end is too short and gets shorter every month as the year progresses. How do you implement strategic adjustments to the business when you only measure on a very short-term basis?

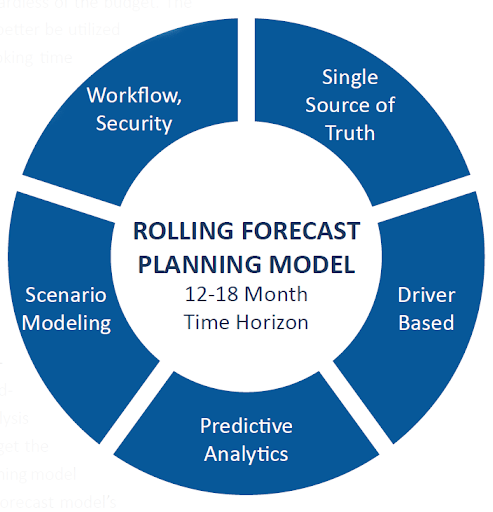

This is where a Rolling Forecast Model can be the answer. For example, an 18-month rolling forecast model updated monthly will always project with a time frame of 18 months. Assumptions are updated to reflect the current and expected conditions regardless of what they were when the budget was created. The impact of new initiatives or other changes in the business can much better be utilized for decision making when the forecast has the relevant forward-looking time horizon.

How to do it?

First, you need the right mindset from the decision-makers. They must start letting go of the annual budget and be open to focusing on the relevant time horizon for the business. Often you need a transition period where you keep the annual budget while moving the organizations towards the rolling forecast model. From a practical point of view, one way of dealing with this is to create a rolling forecast model in Board and use one of the forecast versions to create the annual budget. At first, you may have to compromise on the level of detail to satisfy both the budget and the forecast. However, as you focus on the future, the level of detail needed for the rolling forecast model will prevail.

Automation of redundant tasks is key in a rolling forecast model. It is important that the system automates the process as much as possible, so the model users can focus on the updates they need to make in each version. This makes the model palatable for distributed planning, so you can incorporate input from a larger audience outside of finance.

The key areas to automate includes:

- Automate the versioning process where you transition from one version to another, while leveraging everything that was done in the prior version. I.E you need to roll assumptions and forecast data forward.

- The calculation of the rolling forecast.

This enables the users to focus on updates to the forecast assumptions and the forecast data where necessary.

How to do it in Board?

With the right configuration, Board handles the Rolling Forecast superbly. Here at Peak Analytics, we have specialized in developing rolling forecast applications.

In fact, Board is the game-changer, the enabler of building great applications that can incorporate otherwise impossible requirements.

The key is to have a well-thought-through modeling approach as the foundation, and then incorporate the client-specific requirements to the model design within the main approach. I.E we have a plan with lots of room for flexibility.

The Rolling Forecast model does not exist in a vacuum. Today it has become a key part of a larger planning ecosystem that helps companies drive business performance across the  organization, which unifies financial and operational planning on a single planning platform.

organization, which unifies financial and operational planning on a single planning platform.

This planning ecosystem takes FP&A principles and methods and extends them throughout the organization in collaboration with the operating business units and eliminates the disconnect between finance and operations. Gartner calls this Extended Planning and analysis (xP&A)(1).

It incorporates financial and non-financial operating data and metrics to form a single source of truth as the basis for complete integrated budgeting, forecasting, and reporting solutions across the enterprise.

To learn more about xP&A and how Peak Analytics can help, please download our whitepaper “Drive Business Performance with an Extended Planning and Analysis (xP&A) Solution”.

References

1 Gartner, Innovation Insight for Extended Planning and Analysis (xP&A), Published: 28 October 2020